Quantitative Easing and Financial (In)Stability

Many central banks have introduced quantitative easing (QE) as a new policy tool where they massively buy bonds from market participants to provide liquidity to the market, reduce the cost of capital and ultimately foster economic growth. Although such monetary policy measures by the Federal Reserve and the Bank of Japan seem to have had the desired effect in the home market, there are still many open questions about the effectiveness of QE with respect to its global impact. These policies (and unwinding them later on) have an impact on the stability of financial markets and financial institutions, not only in industrialized countries but also in emerging markets.

This project aims to analyze the potential effects of QE, in particular on the pricing of financial assets, the risk taking by banks, and the spillover effects to emerging markets. The project proposes a new approach to address the topic from a banking and finance perspective.

Key questions:

- How much of the current recovery can actually be attributed to monetary policy intervention, and, in particular, which tool was the most effective?

- What are the consequences of the enormous monetary expansion for financial markets stability? How does it affect risk-taking by banks, and systemic risk more generally? Are there spillover effects to financial institutions and markets in emerging economies, like India, China, or some African countries?

- If some day central banks want to reverse their current extremely lax policy stance, what will happen to securities markets and the banking system? Which withdrawal symptoms should we expect, in terms of negative economic growth and financial instability around the world?

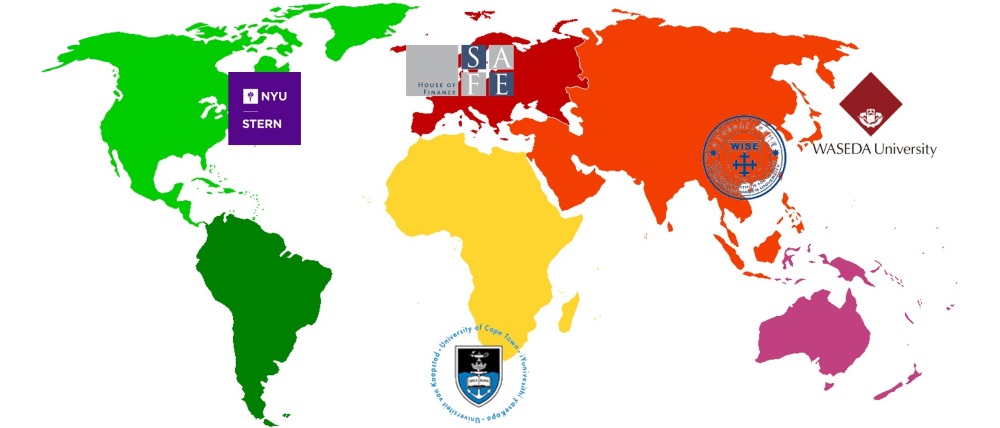

Project Team

- Germany (SAFE)

Junior Researchers Marius Birk Vanessa Endrejat Jun Li (till 06/18) Xu Liu Max Nagel Mihaela Simina Puscasu Christian Resch - United States (NYU)

Senior Researchers Marti G. Subrahmanyam Viral V. Acharya Junior Researchers Max Riedel Michael Schmidt Davide Tomio - China (WISE)

Senior Researchers Marcel Bluhm (till 05/17) Linlin Niu Junior Researchers Xiao Cai Zhiwu Hong (till 07/17) Zhen Huang (till 09/16) Mucai Lin Pengli Ni Rina Su Siqi Wang - South Africa (U. of Cape Town)

Senior Researchers Co-Pierre Georg Junior Researchers Tina Koziol Allan Davids Jesslyn Jonathan - Japan (Waseda)

Senior Researchers Jun Uno Junior Researchers Reiko Tobe - Other collaborators

News & Activities

Closing Conference

The final conference of "Quantitative Easing and Financial (In)Stability" funded by Volkswagen Foundation took place on 1 April 2019 at Goethe University Frankfurt.

The agenda and presentations can be found here, a summary of the event can be found here.

Project Publications

Working Paper

| Author/s | Title | Publication type | Published |

|---|---|---|---|

| Loriana Pelizzon, Marti Subrahmanyam, Davide Tomio | SAFE Working Paper | Aug 2018 | |

| Loriana Pelizzon, Max Riedel, Zorka Simon, Marti Subrahmanyam | SAFE Working Paper | Apr 2020 | |

| Massimiliano Caporin, Loriana Pelizzon, Alberto Plazzi | SAFE Working Paper | May 2020 |

Related Work

| Author/s | Title | Published |

|---|

Research Projects

QE impact on financial markets ...

... in industrialized countries

- The Impact of Unconventional Monetary Policies on European Financial Markets

Loriana Pelizzon, Massimiliano Caporin, Alberto Plazzi - The Impact of QE Interventions on Sovereign Bond Market Microstructure

Loriana Pelizzon, Linlin Niu, Marti G. Subrahmanyam, Jun Uno - Macroeconomic Asset Price Risks in the Presence of the Zero Lower Bound

Christian Schlag, Nicole Branger, Ivan Shaliastovich, Dongho Song

... in emerging countries

- QE, Foreigner Behavior and Market Fragility in the Indian NSE Electronic Equity Order Book Markets

Loriana Pelizzon, Viral Acharya - Signalling and Portfolio Balance Effects of QE Announcements on China’s Yield Curve

Linlin Niu, Yide Chen - The Regulatory Debate Regarding QE and Systemic Risk

Jan Pieter Krahnen, Matthias Thiemann

QE impact on financial institutions ...

... in industrialized countries

- Private Short Term Funding and ECB Unconventional Monetary Policies

Viral Acharya, Diane Pierret, Sascha Steffen - QE and Channels of Systemic Risk

Co-Pierre Georg

... in emerging countries

- Unconventional Monetary Policy, International Spillovers and Systemic Risk

Co-Pierre Georg - The Topology of the South Africa Interbank Network

Co-Pierre Georg, Jan Pieter Krahnen

In this Section: