Financial advisors should help their clients to find optimal investment products depending on their personal financial situation and their preferences. However, when using investment accounts based on commission schemes, the incentives of financial institutions and private investors might not be aligned. To protect private investors, some regulators have reacted by increasing transparency or by banning sales commissions altogether, such as in the UK and the Netherlands. Do private investors change their behavior in response to commission bans? Do they benefit from flat-fee schemes for financial products by improving their portfolio efficiency? In a field experiment in Germany, we analyze de-identified data from an online bank operating in the German market between January 2008 and December 2015 to answer these questions. The bank was one of the first to introduce a flat-rate option for trading and holding mutual funds – beside the bank’s traditional commission scheme. When choosing the flat-rate, clients pay 1% p.a. of their total portfolio holdings. In exchange, clients can trade all mutual funds without paying any commissions. Under the traditional commission scheme, clients pay front-loads to the bank when purchasing mutual funds (on average, 2%) and annual management fees.

Flat-rate users benefit

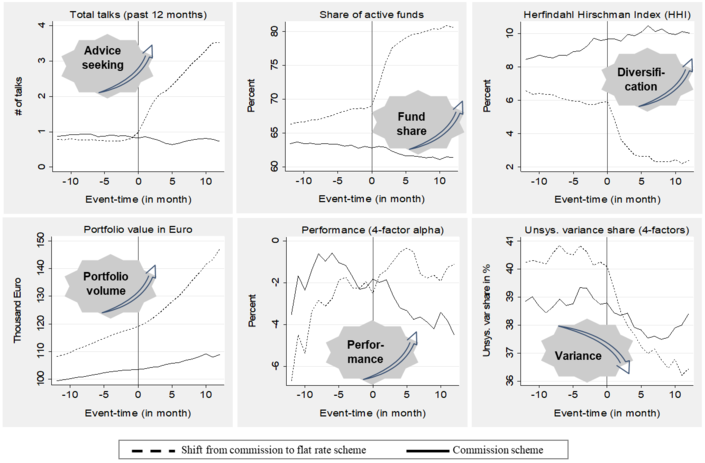

We find that clients with a higher portfolio value, larger fund shares, and better portfolio efficiency (diversification and performance) are more likely to opt in for the flat-rate scheme service. Clients choosing the flat-rate seem to be more financially sophisticated than their peers, who continue to take advice under the commission scheme. Clients change their investment behavior (relative to a control group) immediately after switching from the commission to the flat-rate service. Figure 1 shows the date when a client switches in the flat-rate (event-time 0) and the months before and after the switch. Users of the flat-rate (dotted line) talk more to their advisor and increase their share of mutual funds, which increases their portfolio diversification. Users of the flat-rate also invest more in the stock market as they increase their portfolio values. Overall, clients benefit from using the flat-rate by increasing their performance and reducing their portfolio volatility.

Figure 1: This figure shows the effect of the switch from the commission to the flat-rate scheme onmeasures of advice usage, portfolio allocation, and portfolio performance for switching clients compared with propensity-score-matched commission scheme clients in event time, analyzing the 12 months before and after the switch. Switchers are defined as commission scheme clients who switch to the flat-rate scheme. The dotted line illustrates clients switching into the new flat-rate, whereas the solid line shows the propensity-score-matched control group of non-switchers.

Boosting trust in financial advice

Our results suggest that under the flat-rate scheme, clients are more likely to rely on financial advisors, especially in more complex and international products. But why? As financial advisors do not earn a commission with each product sold, clients reported in a survey that they perceive the advice under the flat-rate of higher quality than that under the commission scheme. As a result, clients trust their financial advisor more under the new flat-rate service. These customers associate the flat-rate at the bank with fairer and better advisor recommendations and feel more confident in investing in international capital markets. Overall, clients show to benefit more from using flat-rate services than commission-based investment services. This is surprising, as neither the financial advice nor services change. The substantial and beneficial change in investors’ behavior is simply the result of changing the pricing scheme. According to our study, motivating people to use flat-rate services or offering other no-commission alternatives could improve the financial well-being of private investors when it comes to financial advice.

Charline Uhr is currently pursuing a Ph.D. at Goethe University Frankfurt and the Leibniz Institute for Financial Research SAFE and is visiting PhD student at University of Southern Denmark.

Steffen Meyer is Associate Professor of Finance at University of Southern Denmark & Danish Finance Institute and is a research fellow at SAFE.

Andreas Hackethal is director of SAFE's Department Household Finance and Professor of Finance at Goethe University in Frankfurt.

Benjamin Loos is Associate Professor of Finance at University of Technology Sydney.

The project was partly funded by the Think Forward initiative.