Information is essential for efficient opinion formation. In all economic processes, however, information is distributed asymmetrically, which makes the exchange of information essential for individuals to form opinions. The paper “Let me get back to you - A machine learning approach to measuring non-answers” deals with the measurement of information exchange. The paper develops a methodology that can identify content-less responses (“non-answers”). Furthermore, the paper documents that companies or managers who do not answer investors’ and analysts’ questions accurately show significantly worse stock performance.

Yet, evasive answers to questions are not solely an economic phenomenon but have been an interesting field of research in many disciplines for years. Due to its topicality, the election of the next German Bundestag is in particular focus these days. For this reason, we apply a method similar to that of the above essay to the answers of the so-called truel of the candidates for chancellor on 12 September 2021.

Less than two minutes into the truel, moderator Oliver Köhr states, after an evasive answer, "I can't force you to answer." This raises the question of whether and how precisely the candidates Annalena Baerbock (Green Party), Armin Laschet (Christian Democratic Union of Germany), and Olaf Scholz (Social Democratic Party of Germany) have generally answered the questions addressed to them.

Machine learning can be used to capture the precision of responses

Quantifying the precision of an answer has been the focus of social science research for some time. In our research, we are concerned with identifying answers that do not adequately answer the actual question. While it is relatively difficult for a human to evaluate the precision of answers, it is easier for a computer to do so using modern machine learning methods. And it is precisely such methods that this paper applies to the Chancellor truel.

Question and answer situations, such as in interviews, are the most direct way of obtaining information and thus more interesting than one-sided (press) statements in which the information provider determines the context herself. In questions, on the other hand, the information seeker determines the (possibly critical) context. In the present case, the aim is to determine how close the answers of the candidates for chancellor are to the thematic context of the question.

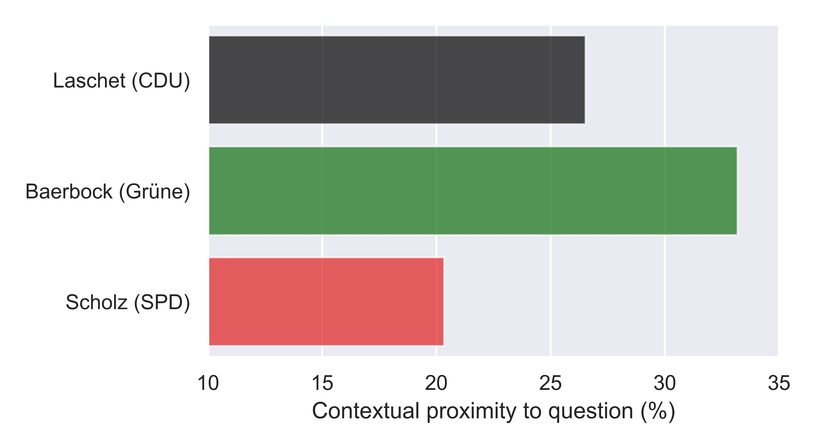

According to our analyses, Annalena Baerbock's answers are closest to the moderators' questions, followed by Armin Laschet and Olaf Scholz. Figure 1 shows average values across all pairs of questions and answers during the truel and is, therefore, a simplified representation.

In a commentary on the broadcast, the German news platform “Tagesschau” writes: “Baerbock was smart enough to largely stay out of the squabbles between the two men.” The bilateral discussions could be a factor in explaining Ms. Baerbock’s in-context answers and likewise, explain the digression of candidates Laschet and Scholz from the original question. In addition, of course, Mr. Laschet’s and Mr. Scholz's years of experience in turning around questions by journalists could also play a role. "The Artful Dodger" - a core competence on the political stage.

For the audience, it is certainly necessary to separate the competence of rhetorically good speaking from the substantive side. The former is reflected in the subjective feeling of the audience, whereas the latter refers solely to Friedemann Schulz von Thun’s factual level. Finally, we are interested in the actual content of the answers. The following word clouds, which weigh the font size with the word frequency, should provide information on this. All candidates agree on one thing: they “must” do a lot after the election.

Jun.-Prof. Dr. Andreas Barth is a Junior Professor of Digital Transformation in Finance and Accounting at Saarland University and is an associate researcher at the House of Finance at Goethe University Frankfurt.

Sasan Mansouri is a PhD student at the House of Finance at Goethe University Frankfurt.

Dr. Fabian Woebbeking is a research associate at the House of Finance at Goethe University Frankfurt.

Blog entries represent the authors’ personal opinion and do not necessarily reflect the views of the Leibniz Institute for Financial Research SAFE or its staff.