Dry-ups in funding markets often lead to financial crises, with adverse macroeconomic consequences. Understanding the dynamics of funding markets is therefore important. However, isolating the effect of a funding dry-up from broader crisis effects is a challenge for empirical research as they usually go hand-in-hand.

In our paper “Spillovers of funding dry-ups”, we study the dynamics of funding dry-ups and provide evidence of a new channel through which funding dry-ups spill over from one funding market to others: When banks face a funding shortage in one market, they substitute into other sources of funding, intensifying competition in those markets. As a result, banks that are not directly affected by the original funding dry-up might nevertheless face a funding squeeze, as they are crowded out by the directly affected banks in the latter's search for alternative funding.

Identification strategy

We combine three granular datasets with detailed information on (i) the level of MMF funding to banks, (ii) banks’ bid-level information on corporate deposit auctions in various currencies, and (iii) detailed data on banks’ syndicated lending. For identification, we exploit a policy event, the US money market fund (MMF) reform in 2016, which required institutional prime funds and municipal funds to switch from a stable to a floating net asset valuation calculation and introduced redemption gates and fees at the discretion of the fund. As a result, the reform led to the conversion of many prime funds to government funds, resulting in a dollar funding loss for many non-US banks.

The MMF reform constitutes close to an ideal setting to study channels of spillovers from a funding squeeze. In addition to taking place during an otherwise tranquil period for financial markets, it directly affected only banks that actively borrow from MMFs (which we call MMF banks). This allows for a clean distinction between MMF banks and banks with no direct exposure to MMFs (which we call non-MMF banks). Moreover, since it only affected the dollar wholesale funding of banks, the reform should only have an impact in dollar markets and not in other currencies. As a key part of our identification strategy, we compare MMF and non-MMF banks, pre- and post-reform across different currencies.

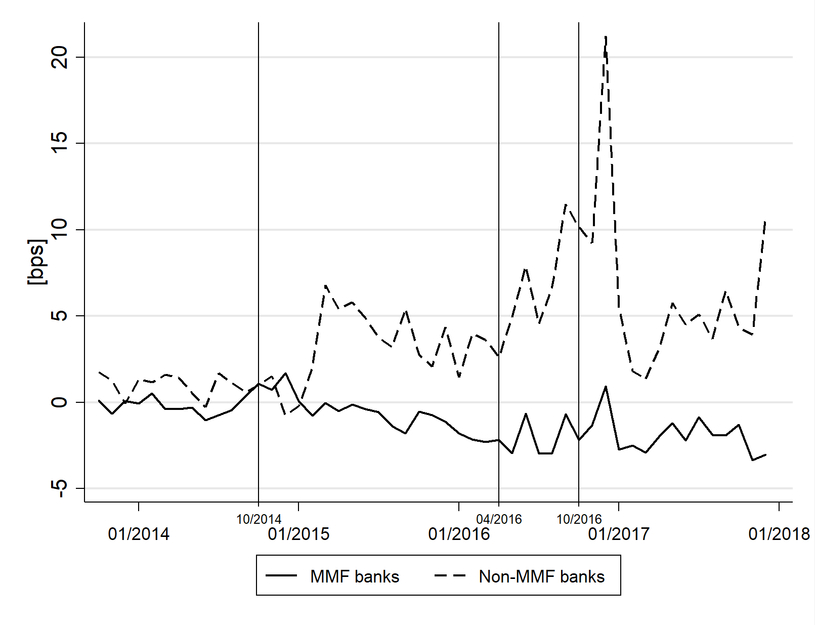

Figure 1: Deposit spread in the US money market fund from 2013 to 2017

We show that the negative funding shock due to the MMF reform spills over to other markets, to banks with no MMF exposure (see Figure 1). Following the reform, non-MMF banks pay higher deposit rates than MMF banks in order to retain their corporate deposit funding. Moreover, we document a composition effect and explain the higher deposit spread that non-MMF banks pay after the reform. Once MMF banks lost MMF funding and intensified competition for corporate deposits, they crowded-out non-MMF banks by securing funding from firms that are most alike MMFs, i.e. stable and large deposit-providing firms. Non-MMF banks were forced to form new relationships with less stable funding providers by bidding higher prices. Importantly, we show that these effects only apply to dollar deposits – there is no effect on pound deposits around the time of the MMF reform. This suggests that the effect is driven by spillovers due to the reform rather than any unobserved heterogeneity between the two groups of banks.

Bank lending: prices and volumes

A natural question that arises from our results is whether, and if so how, bank lending is affected. Assuming the outcomes in the corporate deposit platform are representative of rising costs for non-MMF banks, we ask the following questions: Do banks pass on the rising costs to borrowers? Do banks increase risk-taking to keep their profit margins? Do banks cut their lending in dollars relative to other currencies as the sourcing of dollars becomes more expensive? Or did they lose competitiveness in lending markets through lower demand for their loans because of losing competitiveness in funding markets? We show that non-MMF banks reduced lending rates relative to MMF banks – in particular for dollar loans – yet reduced the relative share of dollar loans in their portfolio. These results suggest that intensified competition in funding markets led to a decrease in profitability by affecting interest margins.

Implications for financial stability

Our results have three major implications for financial stability and policy. First, they highlight that different types of liabilities – such as MMF-provided wholesale funding and corporate deposits – are substitutable to some degree. It is hence important to understand the nature of this substitutability to gauge the reaction of banks in the event of a funding dry-up in one market. Second, in an integrated but segmented financial system, shocks to one market could spill over to other markets and affect other financial institutions. As a result, these spillovers could propagate and amplify the impact of original shocks, including across borders. It is therefore important for policy makers to understand the linkages between different markets and the participants in each market. Finally, these spillovers show that policy reforms can reach beyond their intended impact area. Hence, policy makers should take the possibility of spillovers into account when assessing the potential unintended consequences of their policies.

Jun.-Prof. Dr. Andreas Barth is a Junior Professor of Digital Transformation in Finance and Accounting at Saarland University and is an associate researcher at the House of Finance at Goethe University Frankfurt.

Blog entries represent the authors’ personal opinion and do not necessarily reflect the views of the Leibniz Institute for Financial Research SAFE or its staff.