At the end of November 2019, following growing market demand and public pressure to increase investments related to climate and environmental protection, the German Finance Agency has finally announced the issue of the first federal green bond. It took several months of discussion and public debate about this green issue before it was ultimately realized. In contrast to standard approaches, followed by other European governments, such as France, the German Green Bond will be tied to a conventional bond issue, a so-called „twin-bond“. The Green Bond will have the same maturity and the same coupon as its conventional twin, but a much lower issue volume. The German Finance Agency will further commit to exchange green bonds for conventional bonds at any time. This is to ensure that green federal bonds have the same liquidity as conventional bonds. Furthermore, to increase pricing transparency, Germany plans to issue Green Bonds along the whole yield curve. The total issue volume will amount to several billions of euro, although the exact numbers are still unclear since they will depend on the federal government’s environmental spending.

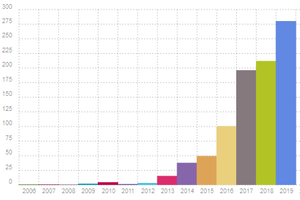

Market participants welcomed the announcement of the German Finance Agency. Green bonds sold by Europe’s benchmark issuer have by all means the potential to boost the green bond market. When green bonds first emerged in 2006, investors considered them a niche product for a particular clientele. It took nine years before the annual issuance reached 100 billion dollar. In 2019, however, the green bonds market is by far no longer a niche segment (see figure).

Total market value of green bonds in billion dollar per year

Source: bonddata.org, as of 9 December 2019

Governments and corporations issue now green bonds in over 30 different currencies across the globe, with the cumulative issue volume expected to reach one trillion dollar soon.

Nevertheless, critics have raised several points concerning the rather specific structure of German Green Bonds. It is particularly not clear, whether the additional convertibility feature is appropriate. Especially private investors might be skeptical given this degree of complexity, and some institutional investors might even avoid convertible bonds. The concerns of the agency that, through the lower liquidity of Green Bonds compared to conventional bonds, their pricing might suffer do not seem appropriate. First, the planned issue volume of the German Green Bond by no means is unusually low. An average green bond has an issue volume below 500 million euro, and there are only very few with a volume above one billion, which will be the lower bound for the German Bond. Second, several studies (see, for example, Zerbib, D., 2019 and Kapraun, J. and C. Scheins, 2019) have shown that the demand for government bonds is particularly high and that investors regard the corresponding Green label as particularly valuable.

Germany is lagging in Europe

Another point of concern for sustainability-oriented investors might be the fact that, in a first step, German government bonds will not finance new environmental projects but re-finance existing ones. However, the term “Greenwashing” is not appropriate here. Generally, Greenwashing describes misleading claims regarding Green credentials of a corresponding project, i.e., when the proceeds are spent to a large degree on rather “brown” projects. In case of the German Green bonds, existing projects from the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety will be screened regarding their alignment with the Green Bond Principles of the International Capital Market Association (ICMA) and European Green Bond Taxonomy. Furthermore, the German Green Bonds can also potentially finance new projects initiated by the Energy and Climate Fund (EKF).

Although Germany belongs to the top five globally with respect to cumulative green bond issuance, the market growth resulted so far from a small number of financial and non-financial corporations and government-backed entities. Around 50 percent of issuance volume comes from the state-owned development bank Kreditanstalt für Wiederaufbau (KfW), which alone has issued a total of 21 billion euro by September 2019.

However, when it comes to environmental commitments on a federal level, Germany is lagging in Europe. For instance, according to the Environmental Performance Index of 2018 developed at Yale University, which evaluates national efforts about environmental issues, Germany ranks number 13 behind many other European countries such as Switzerland, Denmark, or France. In particular, the French government has carried out many national initiatives to reduce environmental issues, financed through several large sovereign green bonds. Similarly, other European countries, such as Poland, Netherlands, Ireland, or Belgium have successfully placed green government bonds with huge oversubscription rates. Interestingly, a significant share of orders for the environmentally friendly bonds came from institutional investors in Germany.

Thus, there are good arguments that AAA-rated German Green Bonds will meet very strong investor demand. Furthermore, through the efforts of the German government to provide transparency in terms of eligibility of green projects, external certification, and impact reporting, in comparison to other sovereign bonds, the German Green Bonds will be of a very dark green shade.

With the first green federal bond, Germany fulfills its obligations as a benchmark issuer and finally starts catching up, albeit slowly, with European peers on the green path.

Julia Kapraun is Assistant Professor in the Finance Department of Goethe University. Her focus of research is on sustainable finance, behavioral finance and investment decisions.