How do sovereign and domestic corporate credit risk interact with each other? Given the soaring level of outstanding corporate and sovereign debt in developed economies, a deep understanding of the channels at work in such relation is of paramount importance from both an academic and a policy perspective. For financial firms, and most notably banks, a fundamental characterization of the channels at work has been formalized through the so-called “doom loop,” which derives from the combination of bank exposures and bailout (see, e.g., Acharya et al., 2014; Brunnermeier et al., 2016; Farhi and Tirole, 2018).

There is also some empirical evidence that credit risk spillovers take place between the sovereign and the domestic non-financial sectors (see, e.g., Lee et al., 2016; Almeida et al., 2017). The sobering message from this literature is that a rise in sovereign risk generates negative externalities on the ability of corporations to service their debt, and hence on their creditworthiness. These externalities are generally deemed to be exacerbated in governments with already low fiscal space and high credit spreads, for which a further deterioration in credit conditions would raise concerns of future increases in corporate taxes and more generally a disruption in the legal, political, and economic framework (Corsetti et al., 2013; Augustin et al., 2018).

In a recent SAFE Working Paper (Jappelli, Pelizzon, and Plazzi, 2021), we make three contributions to advance our understanding of credit markets. First, we document a strengthening of the corporate-sovereign credit risk relation at the COVID-19 outbreak only in countries that have strong fiscal capacity. This evidence is robust to the inclusion of a wide array of firm and country characteristics. Direct econometric tests point toward a pivotal role of public finances through the pricing of expected government support as factored in forward-looking market prices. Our second contribution is to develop an asset pricing model featuring the stochastic occurrence of a rare disaster. In the model, government support acts by putting a ceiling to the severity of the disaster for companies’ default risk. The model enables us to formalize the transmission of fiscal capacity to the pricing of corporate claims. Third, we use a synthetic control approach to estimate the model-implied ratio of government support for core and peripheral countries during the pandemic. We are thus able to quantify how the strength of public finances affects firms’ credit risk pricing, and ultimately their cost of capital.

We draw our conclusions from a daily sample of credit default swap (CDS) spreads referencing large non-financial corporations and their sovereigns across nine countries in the European Union from January 2019 to September 2020 along with data on stock returns and firm and country level controls. We divide the countries into two groups: five countries at the core, with relatively strong fiscal capacity (Belgium, Finland, France, Germany, and the Netherlands); and four countries in the periphery, with relatively weak public finances (Italy, Greece, Portugal and Spain), even though the results are very robust to disaggregated data. All these EU countries responded to the COVID-19 shock by imposing similar economic freezes during the sample period we consider, accompanied with support to households and non-financial institutions. The exogenous and unanticipated disaster-induced repricing allows us to trace cleanly how the events developed in the time dimension. In the cross-section, our focus on the EU avails us with an ideal setting, where monetary policy, exchange rates and the pandemic intensity are homogeneous.

What drives credit risk co-movements?

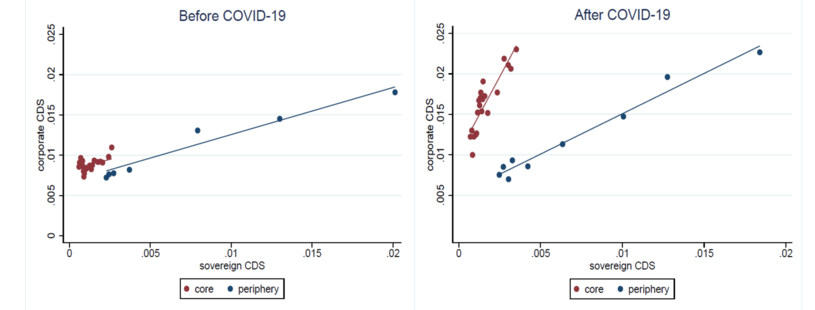

As a first step in our analysis, Figure 1 illustrates the relation between government and corporate CDS spreads around the COVID-19 pandemic by means of a binned scatterplot. Observations are grouped into equal-width bins, and points in the diagram correspond to within-bin averages of corporate and sovereign spreads. The top plot is for the pre-COVID19 sample (i.e., from January 1, 2019, until February 23, 2020), while the bottom one refers to the COVID-19 period. By observing the graphs, two conclusions emerge. First, two distinct data clusters arise within each plot, coherently with the core/periphery classification. Second, it appears that the pandemic was accompanied with a mild steepening of the relation in peripheral countries, and a much more pronounced one in the core. Thus, first-pass evidence indicates that the outbreak strongly affected unconditional credit risk co-movement in fiscally strong countries.

Figure 1: Credit risk co-movement: This figure shows a binned scatterplot of sovereign and corporate CDS spreads per unit of notional, before and after the COVID-19 shock (top and bottom panel, respectively). Observations are first grouped into equal-width bins. Data points in the diagram correspond to within-bin averages of the x-axis and y-axis variables.

To formally test whether this result holds also conditionally on a variety of factors, we resort to a panel regression model with corporate CDS spreads as the dependent variable. The setting allows us to exploit the granularity of the data and pin down the relation between corporate and government CDS spreads conditional on aggregate and firm-level controls. In addition, and specific to the evolution of the COVID-19 shock, firm credit risk ultimately reacted to a government decision to impose national lockdowns halting, in part or in full, a number of corporate activities, so it is natural to think of the former as the outcome variable.

Following Acharya et al. (2014), we work with daily growth rates in CDS; namely, first differences in log (sovereign and corporate) CDS spreads. This setup enhances the stationarity of the data, given that CDS are highly persistent on a daily basis, and is better suited for a panel of firms and countries that differ in the levels of spreads. Therefore, we measure the nexus with the sensitivity (i.e., elasticity) of a firm’s credit risk to that of its sovereign. That is, we estimate the degree of risk transfers between corporation i and sovereign j in a daily panel regression model. In our difference-in-differences setup, we interact all explanatory variables with a dummy that equals one during the COVID-19 period (defined as the days after February 24, 2020) and zero otherwise, and we estimate the model separately by core and peripheral countries. Our findings suggest that the COVID-19 pandemic had a massive impact on the corporate-sovereign nexus only for companies in the core. The estimate implies that the sensitivity of these companies’ credit spreads to shocks in their sovereigns effectively doubled during the period, bringing the overall impact to a level of about 0.25 – thus, a 10 percent increase in sovereign spreads in the second half of the sample translates into an expected 2.5 percent increase in spreads for corporate sector debt.

Notably, this figure is at par with that of companies in the periphery, for which the additional contribution from the COVID-19 sample is a meager 0.052 (statistically insignificant). Summarizing, the pandemic was accompanied with an economically and statistically significant increase in the co-movement between corporate and sovereign credit risk in core countries only. In the periphery, the sensitivity was already high before the COVID-19 shock and did not markedly change thereafter. Considering that our sample covers non-financial firms with an overall market cap of e3.25 trillions – about 56 percent of the EU market – the economic magnitude of this effect cannot be understated.

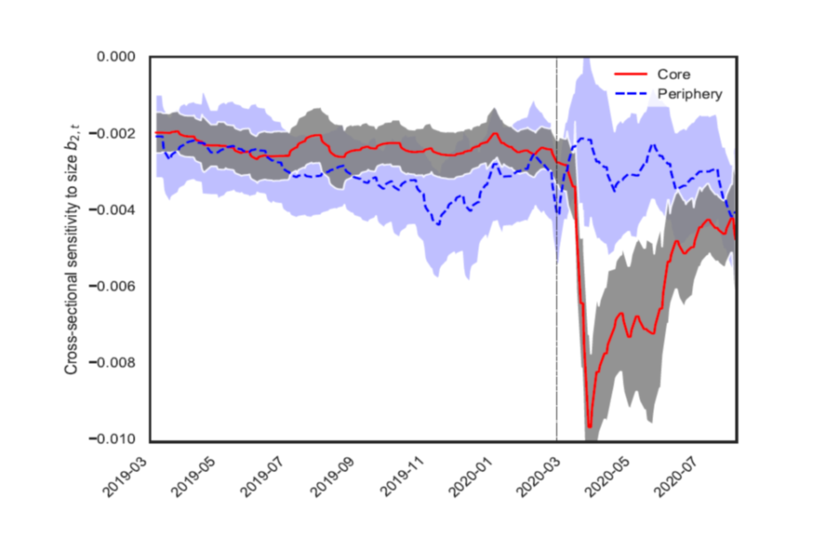

This finding suggests that a major determinant of the corporate-sovereign nexus in the aftermath of the pandemic is a ‘government support channel’ (Acharya et al., 2014), which views spillovers as resulting from the expectation of public liquidity and solvency provisions. Overall, our data show that the repricing of credit risk in the face of the shock led to a tighter corporate-sovereign relation in countries that were better positioned to extend public support. Markets expectations of sovereign fiscal support is a decisive factor of financing costs for domestic corporations when systemic tail risk materializes. The result is robust to the inclusion of a wealth of country and firm characteristics that proxy for the sensitivity to the shock — such as, the severity of lockdown policies and the degree of trade openness of states, and the liquidity and financing structure of businesses – and to several econometric tests. Extracting distance to defaults, we show in Figure 2 that at the outbreak of the COVID-19 shock, actual CDS spreads were priced at a discount with respect to predicted spreads only in the case of large(r) companies located in core EU countries.

Figure 2: Deviations of CDS from fundamental credit risk as function of size: We calculate the model implied CDS rate from the Merton (1974) model and estimate regressions of CDS spreads on the spread predicted by the Merton model, size, and leverage, separately for core and peripheral countries. The plot displays the trailing average of the time series of the estimated coefficient on size with one standard deviation bands. The dash-dot vertical line marks February 24, 2020.

Building on Gandhi et al. (2020), we propose a theoretical framework to understand how the strength of government support affects the nexus between sovereign and corporate credit risk in the face of a rare disaster. In the model, a disaster triggers a negative jump in consumption and an increase in corporate credit risk through a jump in the default intensity of non-financial corporations. The government can provide collective guarantees through a ceiling on the size of the jump, thereby limiting the increase in the level of credit spreads. However, when the guarantee is activated, it causes an increase in the default risk of public debt that is commensurate with the portion of the shock that the government has absorbed. The model predicts the nexus to be higher in countries where the government is better able to shield corporate credit risk through public guarantees, i.e., in countries whose government is perceived to have larger fiscal space. We bring the model to the data through the Abadie et al. (2010) synthetic control method, which allows to isolate the effect of guarantees on CDS pricing. We obtain an estimate of about 2.6 for the model-implied risk-adjusted ratio of government support of core versus peripheral countries as priced in credit markets over the medium term.

Macroeconomic Implications

Our findings have broad implications in light of the debate around the benefits of fiscal capacity. Recently, Blanchard (2019) argues that in a low interest rate environment, high public debt may not imply large fiscal costs. However, provided markets are informationally efficient, our analysis uncovers a positive effect originating from sovereign fiscal space, as spending capacity buffers directly spill over to corporate credit risk following disaster-induced repricing. Ultimately, this effect lowers corporate credit spreads – and hence the cost of capital – for companies headquartered in fiscally sound countries, thereby increasing their resiliency.

Ruggero Jappelli is Junior Researcher at SAFE in the Department of Financial Markets.

Loriana Pelizzon is Director of the Department Financial Markets at SAFE.

Alberto Plazzi is Professor of Finance at Universita' della Svizzera italiana (Lugano).

Blog entries represent the authors‘ personal opinion and do not necessarily reflect the views of the Leibniz Institute for Financial Research SAFE or its staff.

References

Abadie, A., A. Diamond, and J. Hainmueller. 2010. Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program. Journal of the American Statistical Association 105:493–505.

Acharya, V., I. Drechsler, and P. Schnabl. 2014. A pyrrhic victory? Bank bailouts and sovereign credit risk. The Journal of Finance 69:2689–739.

Almeida, H., I. Cunha, M. A. Ferreira, and F. Restrepo. 2017. The real effects of credit ratings: The sovereign ceiling channel. The Journal of Finance 72:249–90.

Augustin, P., H. Boustanifar, J. Breckenfelder, and J. Schnitzler. 2018. Sovereign to corporate risk spillovers. Journal of Money, Credit and Banking 50:857–91.

Blanchard, O. 2019. Public debt and low interest rates. American Economic Review 109:1197–229.

Brunnermeier, M. K., L. Garicano, P. R. Lane, M. Pagano, R. Reis, T. Santos, D. Thesmar, S. Van Nieuwerburgh, and D. Vayanos. 2016. The sovereign-bank diabolic loop and ESBies. American Economic Review 106:508–12.

Corsetti, G., K. Kuester, A. Meier, and G. J. Muller. 2013.¨ Sovereign risk, fiscal policy, and macroeconomic stability. The Economic Journal 123:99–132.

Farhi, E., and J. Tirole. 2018. Deadly embrace: Sovereign and financial balance sheets doom loops. The Review of Economic Studies 85:1781–823.

Gandhi, P., H. Lustig, and A. Plazzi. 2020. Equity is cheap for large financial institutions. The Review of Financial Studies 33:4231–71.

Jappelli, R., L. Pelizzon, and A. Plazzi. 2021. The core, the periphery, and the disaster: Corporatesovereign nexus in COVID-19 times.

Lee, J., A. Naranjo, and S. Sirmans. 2016. Exodus from sovereign risk: Global asset and information networks in the pricing of corporate credit risk. The Journal of Finance 71:1813–6.

Merton, R. C. 1974. On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance 29:449–70.