In response to Russia’s war against Ukraine, Germany, together with the European Union and international partners, has adopted sanctions to weaken the Russian economy and political elite. As further measures, different versions of an energy embargo are being discussed, which are to hit Russia hard. However, Russia is likely to tackle the economic consequences of this kind of embargo, argues Alfons Weichenrieder, Research Fellow at the Leibniz Institute for Financial Research SAFE and Professor of Finance at Goethe University Frankfurt, in a recent SAFE Policy Letter. Russia has already had to cope with considerable drops in resource rent in the past.

“Based on the available data on the Russian budget and expenditures, an energy embargo is unlikely to significantly affect the stability of the Russian economy”, Weichenrieder explains. Russia has maintained a low public deficit and low levels of debt for years. Drastic losses in revenue from oil and gas were largely offset by higher public deficits, for example for the period from 2011 to 2016.

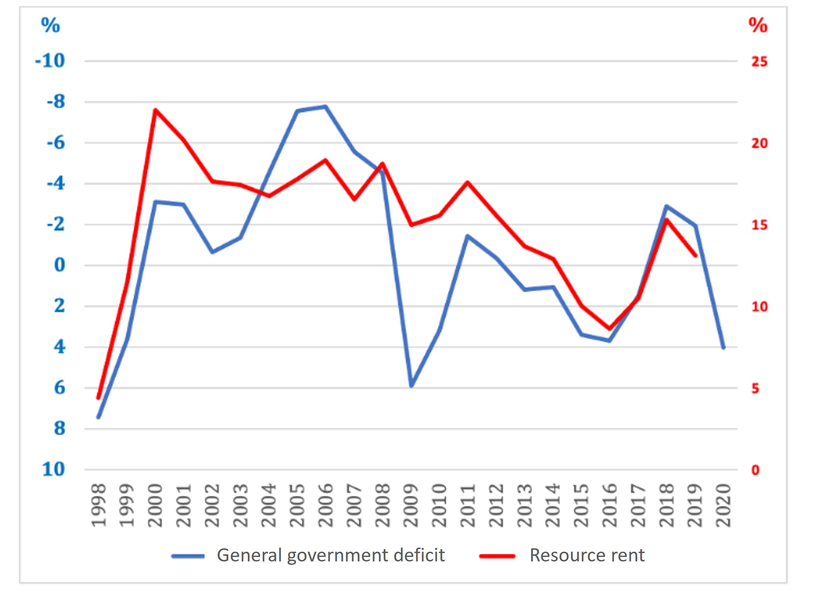

Figure: Public Finance and Resource Rents in Percent of GDP

The blue line is plotted against the left axis and represents the general government deficit in percent of GDP as taken from the IMF, World Economic Outlook Database. Negative values indicate surpluses. The red line is plotted against the right axis and reports resource rent in percent of GDP, as reported by World Bank, World Development Indicators. Note that, to illustrate the negative correlation between the two data series, deficits are reported in reverse order: higher values imply lower absolute deficits. In 2006, for example, the budget had a surplus of roughly eight percent of GDP.

Against this background, Weichenrieder assumes that Russia is currently able to compensate for a drop in resource rent: “Lower capital exports and pressure on domestic investors to buy Russian government bonds could close the financing gap.”

No wipe out on Russian wealth

Furthermore, the SAFE Policy Letter highlights an advantage of natural resources compared to goods and services: “The resource revenues are not lost. Every unit of natural resources that is not extracted today due to sanctions may be available in the future”, the author says. Therefore, an energy embargo would change the portfolio composition, but not wipe out Russian wealth. Things are different in the case of any production shortfalls in the West. Unused capacities can only be made up for in the future to a very limited extent.

Thus, sanctioning Russia through an energy boycott is limited. Consequently, the focus should be on providing more direct economic and equipment support for defending Ukraine, according to the economist.

Download the SAFE Policy Letter No. 96

Press Contact