Brexit also affects the supervision of large banks. Competitive conditions and financial stability increasingly depend on varying regulatory practices. An in-depth analysis by the Leibniz Institute for Financial Research SAFE commissioned by the European Parliament shows that, due to significant differences in the structure of banking supervision, regulatory competition between the United Kingdom and the eurozone countries can certainly be expected. However, tensions or disadvantages in dealing with crises are no likely outcomes of the comparison between British and European supervisory practices.

“By leaving the European Union, the United Kingdom regains more regulatory leeway. A leaner supervisory structure also allows for faster decision making in times of crisis,” says Tobias Tröger, Director of the Cluster Law & Finance at SAFE and one of the authors of the analysis. In contrast, the Single Supervisory Mechanism (SSM) lead by the European Central Bank is a more complex construct. “However, the eurozone is creating a credible safety net for credit institutions in the banking union, which should pay off in the management of future banking crises,” adds Rainer Haselmann, Professor of Financial Economics at Goethe University Frankfurt and SAFE Fellow, who conducted the study together with Tröger.

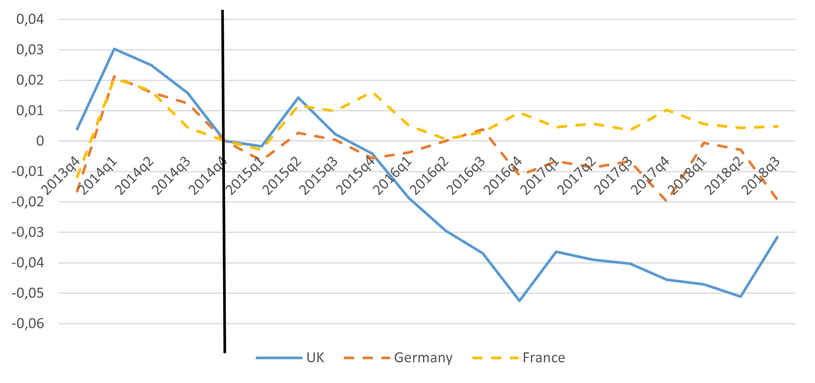

Average risk weights (risk-weighted assets / total assets) for large banks located in the UK, Germany and France over time

Source: own calculations, bank balance sheet data from SNL Financial.

For their analysis, the researchers evaluated existing empirical evidence in the field of banking regulation as well as the current stress test scenarios of the European Banking Authority (EBA) and the Bank of England (BoE). The EBA’s stress test sample currently includes the 50 largest European banks, 38 of which fall directly under the eurozone’s banking supervision. On the British side, the largest institutions are covered as well.

As a result, the comparison of supervisory practices shows that the U.K.’s Prudential Regulation Authority (PRA) takes a much less restrictive approach than the ECB regarding capital requirements for banks. For instance, the PRA applies a lower risk weighting to the credit exposures of the banks it monitors. The researchers observed declining risk weights for large British banks and unchanged risk weights for large German and French banks after the introduction of the SSM (see graphic).

Similar trends can be observed in the macro scenarios underlying the bank stress tests conducted in 2021. Here, the BoE is much more optimistic than the EBA with regard to both economic growth and the unemployment rate, forecasting a rapid recovery from the pandemic-related downturn. “However, in our analysis we do not predict a race to the bottom between the U.K. and the eurozone with regard to prudential standards,” Tröger says.

According to the authors, joint supervision and resolution, including backstops, in the European banking union provide strong public safeguards for financial institutions in the member states. “This safety net should facilitate the efficient management of future banking crises,” says Haselmann. Thus, eurozone banks should be able to count on more favorable refinancing conditions and lower costs of capital, which can offset disadvantages of the comparatively complicated supervisory architecture in Europe.

Download the in-depth analysis as SAFE White Paper No. 86

Scientific contact