“Make hay while the sun shines.” In accordance with this saying, public finance theory recommends governments to budget “counter-cyclically”: to implement austerity measures when the economic environment is healthy instead of worsen recessions with further fiscal cuts. In reality, however, governments do not always follow this principle. Dirk Bursian, Alfons Weichenrieder and Jochen Zimmer examine in a new publication, whether there is a connection between this inefficient behavior and a bad reputation that keeps governments from deferring austerity measures to better times.*

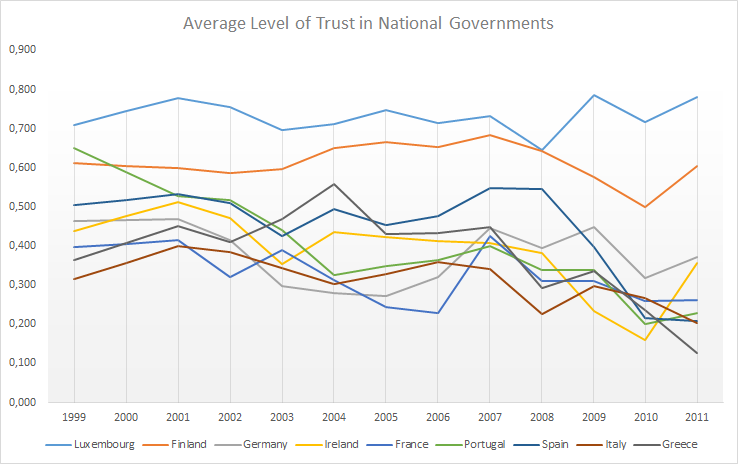

Based on a regular survey across Europe by the EU Commission (“Eurobarometer”), the researchers measure the conviction that European citizens express with regard to their respective public institutions in the period from 1999 to 2011 (see graph). By comparing the results with budget data from the same time they find that the level of trust in governments indeed has implications for fiscal policy and, more specifically, for the development of primary budget deficits. A good fiscal reputation seems to give a government important leeway to run a more expansionary fiscal policy during recessions and to abstain from austerity measures. Altogether, a high level of trust leads to smaller fiscal corrections in time when growth is low.

“Good governance that leads to high levels of trust seems to be important for governments to, in fact, being able to follow a counter-cyclical fiscal policy and to abstain from spontaneous and economically inefficient corrections during bad times,” Alfons Weichenrieder explains. If governments do not benefit from great confidence, they will find it difficult to consolidate in good times, e.g. by raising taxes. As a consequence, they will only be able to correct the budget when the pressure becomes too high.

* Bursian, D., Weichenrieder, A.J., Zimmer, J. (2015)

"Trust in government and fiscal adjustments",

forthcoming in International Tax and Public Finance