The Research Center SAFE and the German business daily Börsen-Zeitung created a new web tool that provides information about the current outstanding subordinated debt of 36 large banks headquartered in 15 European countries: the Bail-In Tracker (www.bail-in-tracker.eu). According to the European Bank Recovery and Resolution Directive (BRRD), a bank’s subordinated debt is a pivotal debt instrument to be bailed in if a bank’s Tier 2 capital is not sufficient. A bail-in implies that the banks’ creditors have to share the burden in case of financial distress by converting parts of their debt into equity. The Bail-In Tracker displays European banks' outstanding publicly traded subordinated debt, calculated for each week since July 2011, and provides regularly updated information on the magnitude of a potential bail-in of the most critical balance-sheet position at each of these banks.

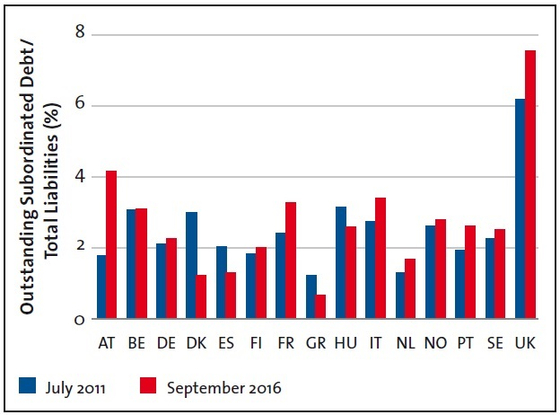

Martin Götz, SAFE Professor for Regulation and Stability of Financial Institutions and responsible for the economic analysis based on the provided data, elaborates on the project and first results of the data analysis in an interview in the current issue of the Research Center SAFE’s Newsletter (Q4 2016). He reports that the share of subordinated debt in percentage of total liabilities at the analyzed banks has remained fairly stable since 2011, at a little less than 3 percent. Differences among institutions are however large. According to Götz, banks that hold less equity capital, thus having less of an equity buffer, tend to have a higher level of subordinated debt which implies that this debt may be more likely to be subject to a bail-in. Also, the data reveal large differences across European countries: While banks in the United Kingdom hold about 7.5 percent of their liabilities in subordinated debt, the share is only about 1 percent at financial institutions in Greece, Denmark and Spain (see figure 1).

Figure 1: Average size of outstanding subordinated debt in total liabilities across countries in July 2011 and September 2016.

Further results of the data analysis include the finding that banks headquartered in the eurozone issue about 15 percent of their public subordinated debt in a currency other than the euro, and that about a quarter of the institutions issue this debt at a subsidiary level instead of the parent level.

The interdisciplinary project team of the Bail-In Tracker consists of – next to Martin Götz – Tobias Tröger, SAFE Professor of Private Law, Trade and Business Law, Jurisprudence (both Goethe University) and Stephan Lorz, Head of the Economy and Economic Policy Desk at Börsen-Zeitung. The project received a grant from the VolkswagenStiftung in the call for proposals “Science and Data Journalism”.