The discussion about ABS purchases by the ECB should be used to agree on minimum holding restrictions for the issuing bank

Jan Pieter Krahnen, Professor of Finance at Goethe University Frankfurt and director of the research centers SAFE and Center for Financial Studies, suggests to use the discussion about the ABS purchases of the European Central Bank (ECB) to come to an appropriate regulation of Asset Backed Securites (ABS). “The economic evaluation of the purchasing program depends primarily on the question of which share of the security’s first losses the issuing bank needs to hold on to.” If the issuer is obliged to retain the first loss pieces, this will secure the quality of the other tranches as well. Only in such a regulatory environment will the mezzanine and senior tranches represent a good investment for the ECB. “We need to discuss the exact construction of the ABS purchasing program by the ECB before sweepingly praising or condemning it,” Krahnen says. Although current regulation calls for a minimum retention share, it does not clearly define from which tranche this share needs to come. This is insufficient, Krahnen says.

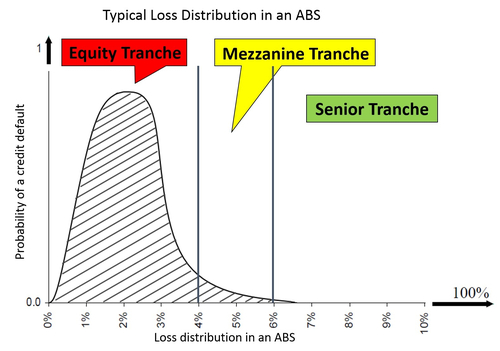

The credits that are securitized within an ABS are divided into tranches according to their creditworthiness: senior tranche, mezzanine tranche(s) and equity or first loss tranche. Each of these tranches represents a bond of its own, with a specified issuing volume, maturity period, and interest payment. Losses usually accrue only in the equity tranche and, with smaller probability, in the mezzanine tranche (see figure). The less risky bond, the senior tranche, which usually has an AAA rating, represents the largest part of the securitization. This tranche entails nearly no default risk.

The shaded area represents the distribution of losses within the ABS. On average, the different tranches incur the following loss shares: equity tranche > first 90%, mezzanine tranche 7-9%, senior tranche < 1%.

Jan Krahnen is surprised that the ECB, according to the program details published on October 2, wants to accept also tranches with a BBB rating, referring to them also as “senior tranches”. “This would make it even more important that a substantial part of the equity tranche is retained by the issuer. Even if the ECB purchases mezzanine tranches, the risks are containable as long as the lending institution retains the first losses.” The reason is that only in this case the lending bank has an incentive to precisely assess the borrower’s risks, to monitor the borrower during the repayment term, and to insist on collecting the money. The lack of such incentives in the subprime markets was exactly what contributed decisively to the outbreak of the financial crisis in 2007. “If the lending bank does not retain a share of the credits’ first losses, it is impossible to properly assess the riskiness of the entire securitization,” Krahnen says.

According to Krahnen, it will be obligatory that the ECB set binding and transparent rules for the important details of the planned transactions, namely regarding the share of equity and mezzanine tranches that need to stay with the lending bank. For Krahnen it is elementary that the ECB should take this precautionary measure into consideration in order not to be left with high losses. Of course, however, the ECB's declared aim of freeing credit institutions of risks and, in this way, reallocating equity to new credits for the real economy, will only be realized on a very limited scale. However, in Krahnen's view: “Financial economists are in agreement that securitization of credits is, in the first place, a funding instrument and, at best, only secondly an instrument to transfer risks.”

See also: Jan Pieter Krahnen: "ECB faces a dilemma with planned ABS program"

(Press release of 12 September 2014)